Investment plays a central role even in crypto market

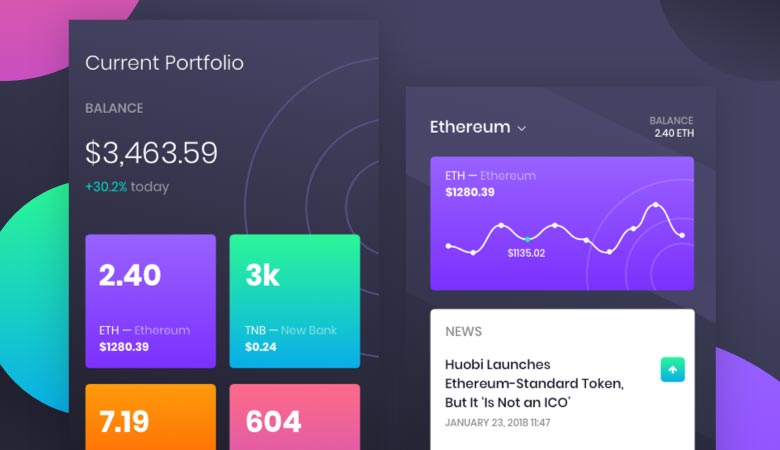

Investment plays a central role in crypto market these days, by increasing the productive capacity of the economy and generating increased employment. Diversification can help mitigate some of the risk of solely investing in one type of market. A good portfolio would include the stock market, real estate, bonds and cryptocurrency investments. Technologies are constantly evolving, increasing the productivity and sustainability for investors looking to buy into the market.

The cryptocurrency market is a high-risk investment, where the value of the coin can greatly change each day with high gains or loses. A diversified investment portfolio including stocks or real estate can help mitigate some of the risk.

Create a digital strategy

To organize your efforts and target the most promising initiatives, first you need a comprehensive plan.

IT has often been seen as a function of the organization like any other. There was no overall view of the company’s objectives or technological development. For example, finance would acquire an accounting system and HR would purchase another personnel management software without any coordination. By creating silos of information, systems don’t communicate with each other. Instead of doing this, integrate technology with the rest of your business with a digital strategy. So we should place technology at the heart of business strategy and select technologies that are in line with your business objectives. We have many experience to do it.

Benefits of money

decentralization.

When technology is centralized, it typically means that it is controlled and run by a single company, government, or individual. Decentralized technology on the other hand, is run by a network of participants that no one actor can control or shut down. Here are some benefits of decentralization:

Users don’t have to put trust in a central authority.

We trust companies and governments with our information and money all the time, and it is completely ok to make these decisions on a case by case basis. But we see plenty of examples where this trust lets us down to varying degrees, ranging from the product that you trusted to backup all your photos getting shut down when the startup gets bought or goes out of business, to the social media company selling your data to advertisers who follow you around the internet. In a well designed decentralized network, you should be able to reduce or eliminate the trust that you’re required to put into third parties.

There is less likely to be a single point of failure.

We see single points of failure all the time in the form of outages of centralized web sites. Gmail goes down and productivity halts as you can’t get your email. Your bank’s web site shuts down for maintenance and you can’t do an online transfer to pay your bills. In decentralized networks, no one node going down can take down the entire network, so no matter how many users come and go, your applications should remain up and running.

There is less censorship.

There is less censorship. It is becoming increasingly common that governments shut down their citizens’ access to social media, as they attempt to censor reports of what is going on internally. It is easy for them to shut down access to Twitter, as all they have to do is stop traffic going to Twitter’s central servers. But it is far more difficult for them to censor traffic on a peer to peer network, in which every single outbound packet being sent could be communicating with another peer on the decentralized network, who can then forward that message along.

By decentralization, we can achieve asset distribution. By investing to real asset, we can take safety of asset valuation.

Decentralized networks are more likely to be open development platforms.

This means that anyone can build amazing tools, products, and services on top of decentralized networks. Contrast this with centralized technology which is more often closed off with intentionally limited development opportunities. Open and decentralized doesn’t mean that companies can’t make money. In fact, it means the opposite, as the more great products and tools that are built, the larger the network effects are locking users into the network, and therefore the more opportunities to build great businesses on top. The world wide web itself is a great example of an open network, in which many great businesses such as Amazon, found opportunities to grow enormously due to the network effects of all the great things being built on top of the network.

There is potential for network ownership alignment.

This is the idea that the people who contribute value to a decentralized network receive ownership or economic stake in the network, that becomes more valuable as the network grows. This is one of the most exciting things that blockchain technology brings to decentralized networks, as it allows economics to be designed into the networks themselves, to create the right incentives for early participants to become powerhouse evangelists and value-contributing users. Contrast this to a centralized network where only the company controlling the network receives value as the network grows, and you can see why it’s exciting for users to participate in a decentralized network.

Decentralized networks can be more meritocratic.

The best product, service, or content should be more likely to be recognized and rewarded over time when everyone is playing by the same, transparent rules. If traffic, attention, and economics are distributed instead behind a closed, centralized algorithm, it’s possible that the system is less meritocratic.

Of course decentralized networks come with their own tradeoffs: they can be slower to develop and interact with, they can be more expensive or inefficient to run, and mainstream users may just not care that the backend implementation of their service is decentralized or not, as long as they can accomplish their intended task as easily or cheaply as possible. This last point in particular is a common philosophical stopping point when debating whether or not decentralization is worth the effort.